industry

all-industries

+ 8 more ...

Digital Transformation in FinTech

15 Jul 2021

by Lotte, Digital Content Specialist

15 Jul 2021

by Lotte, Digital Content Specialist

industry

all-industries

digital transformation

digital innovation

FinTech

financial technology

Human Capital Scan

Reach

Contract Chain

fintech

Digital Transformation in FinTech

Table of contents

Contact us

We will get back to you in the next 48 hours.

FinTech, or Financial Technology, is a rapidly growing industry. Lizard Global is specialized in guiding financial institutions in their journey towards a successful digital transformation.

At Lizard Global, we believe that every industry can benefit from a digital transformation. That’s why we focus on designing and developing digital solutions for over 18 different verticals and counting! One of these verticals is FinTech, or Financial Technologies, which is part of a rapidly growing market of automated financial services and processes. Think of the online banking application on your phone or automated and centralized software systems within financial organizations like loan providers. The digital transformation of FinTech is blossoming, and we’re at the forefront. Keep reading to find out more about FinTech at Lizard Global.

The rise of Financial Technologies

The term “FinTech” comes from the combination of the terms “finance” and “technology” and refers to businesses that use technology to optimize and automate financial processes and services. Think of examples like mobile banking, cryptocurrency, insurance, and investment applications. Although FinTech is a rapidly growing industry, it’s been around for quite some time now. Technology has always played a central role in the world of finance, albeit in different forms. The credit card has been around since the 1950s, and the first ATMs were introduced back in 1969. However, since the rise of the Internet and smartphones, financial applications have skyrocketed, making use of modern technologies such as machine learning algorithms, data science, and blockchain.

Banking

Mobile banking forms a core part of the FinTech industry. If you own a smartphone, you probably have a mobile banking app installed on it to easily check your balances, send payment requests, transfer money, and get insights into your spending behavior with visualized analytics, with just a few taps on your screen. An upcoming trend in the mobile banking industry is the so-called “neobank”, which are essentially banks but without any physical locations. All banking processes are done online in a fully digitalized infrastructure.

Insurance

InsurTech is defined by the combination of the terms “insurance” and “technology”, and forms its branch of the FinTech industry. Any kind of technology used by insurance companies to automate/optimize efficiency and other internal processes like customer services are considered InsurTech. From physical product insurance (such as homeowner, car, boat, etc. insurance) to health insurance, the industry is following the digitalization trend of the immense popularity of FinTech. The use of technologies in insurance services can greatly optimize internal insurance procedures, formulas, and much more, saving expenses on both the customer and company sides of the insurance market.

Examples of how InsurTech streamlines its processes are the use of chatbots, which can optimize the customer experience, or the automation of the entire insurance provider lifecycle (application, acceptance, payment, and claim processes). With a digital InsurTech platform, you can fix things like your health insurance without talking to a single person or physically signing a single piece of paper.

Cryptocurrency

Although cryptocurrencies like Bitcoin are usually seen as an industry on their own, it most certainly has deep connections with the FinTech industry. As cryptocurrencies are becoming increasingly popular, it can be expected that they will become a part of our future financial system. Governments and major financial institutions are keeping a close eye on the cryptocurrency trend and even working towards creating their digital currencies, as it provides a heightened sense of security and speeds up business/payment processes.

Investments & Loans

A popular trend in FinTech software is using big data and technology to do risk modeling and analyses related to loans and investments, speeding up contracting and approval processes as well as decreasing the risk of financial setbacks. FinTech is becoming a major player in reshaping Small-Medium Enterprises’ (SME) lending procedures by simplifying the process of connecting financial providers (FP) to SME’s looking for the funds they need to expand.

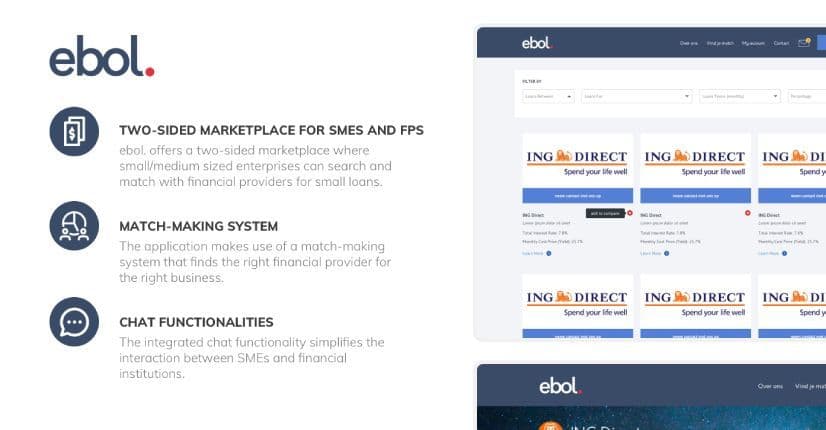

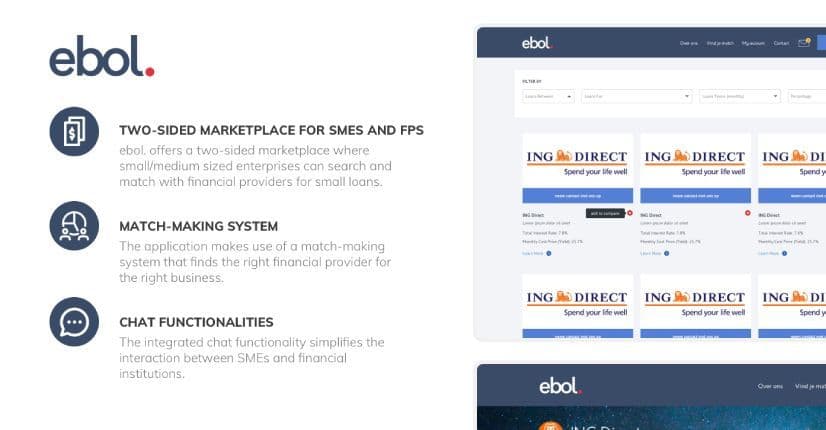

Project: ebol.

Our clients from ebol. provide financial services and facilitate the loan process between financial providers and small and medium-sized companies. Specialized in FinTech (financial technologies), ebol.is always looking for innovative solutions for the financial sector. To optimize their services, ebol. wanted to develop a digital platform on which small and medium-sized businesses can find and match potential financial providers such as banks. The main goal of this digital environment is to facilitate the process of searching and matching between financial providers and businesses to secure small loans.

Together with ebol., Lizard Global designed and developed a digital environment that simplifies the process of searching for potential financial providers (FPs) for small and medium-sized enterprises (SMEs). The two-sided marketplace of ebol. allows businesses to get in touch with financial institutions, like banks, to establish loans.

Project: Contract Chain

The Contract Chain application allows organizations to create, manage, review, and sign contracts in a digital environment. By using blockchain technology, these contracts once reviewed and signed are traceable, transparent, and irreversible, making it one of the most secure contract signing tools in the world. In order to make sure all data of internal processes are handled securely, companies need to have all information stored in a so-called processor agreement. This can be done on paper, but companies with a lot of processing agreements tend to struggle with keeping track of all agreements while ensuring that every document is up-to-date. This struggle asked for a sustainable solution which both simplifies the process of managing digital contracts, as well as optimizing the protection of all user data.

The Contract Chain application and its handling of data run on blockchain technology, which facilitates the safe verification and handling of data transactions. Because blockchain technology is a decentralized system, it exists between all involved parties and takes over the role of a human intermediary or middleman. The technology behind Contract Chain is a perfect example of a FinTech solution. Financial service processes like signing contracts for loans, investments, and payments are becoming much easier and more efficient with the use of automation, and much safer with the use of blockchain technology.

Project: WorldKoins

WorldKoins is a startup platform where small amounts of foreign currency can be exchanged with a virtual currency. With this virtual money, users can buy gift cards and vouchers from renowned companies like Amazon. WorldKoins recognized the problem of the small, residual amounts of foreign currency travelers had left at the end of their trip and couldn’t get rid of. Instead of keeping the money or going to an exchange bank, usually with high commission fees, they should be able to find people who are looking for the same currency in order to exchange their leftover money. Together with WorldKoins, Lizard Global created a platform that connects people who are in possession of “WorldKoins” and are looking for a place to exchange foreign currencies with people who want to get rid of that particular currency. WorldKoins can be exchanged for vouchers with which other products can be bought.

Project: Brickler

Brickler

is a startup innovated by Nationale Nederlanden's mortgages department that takes on the function of the housing market by making it easier to search properties by region, compare mortgages, and apply for loans online. Nationale Nederlanden (NN) aimed to build a single platform where customers could search for a home and apply for a mortgage, all in one digital environment.

Nationale Nederlanden required a professional digital partner who could think through the process in order to optimize the user experience. Lizard Global partnered up with Nationale Nederlanden in order to create a platform that allows consumers to seek a mortgage through a mobile app. Brickler evolved into a cost-effective digital option for home seekers.

Lizard Global and FinTech

With an already impressive portfolio of FinTech projects, Lizard Global is experienced in creating digital solutions to support the digital transformation of various types of financial institutions and services. Not only does our skilled team know exactly what types of technology can optimize the internal processes of your financial business, but we also know that your digital solution needs a solid security system. Applications handling financial business possess a sensitivity regarding the safety of user data, as well as money transfers and more. That’s why we develop apps with security by default and privacy by design. This guarantees the safety of user data that is embedded in the design of our digital solutions. Our app developers create their code in such a way that it requires the least amount of user data in order to function properly.

Want to know more about our secure solutions? Check out our Security Document.

Need a hand?

Curious about our other verticals? Check out our portfolio for an insight into all the industries we’re supporting with digital solutions. Want to know more about our verticals and the clients we’re guiding towards the digital transformation of their business? Or do you want to know what we can do for your business? Drop us a line, and we gladly meet up with you to dive into the possibilities!

FinTech, or Financial Technology, is a rapidly growing industry. Lizard Global is specialized in guiding financial institutions in their journey towards a successful digital transformation.

At Lizard Global, we believe that every industry can benefit from a digital transformation. That’s why we focus on designing and developing digital solutions for over 18 different verticals and counting! One of these verticals is FinTech, or Financial Technologies, which is part of a rapidly growing market of automated financial services and processes. Think of the online banking application on your phone or automated and centralized software systems within financial organizations like loan providers. The digital transformation of FinTech is blossoming, and we’re at the forefront. Keep reading to find out more about FinTech at Lizard Global.

The rise of Financial Technologies

The term “FinTech” comes from the combination of the terms “finance” and “technology” and refers to businesses that use technology to optimize and automate financial processes and services. Think of examples like mobile banking, cryptocurrency, insurance, and investment applications. Although FinTech is a rapidly growing industry, it’s been around for quite some time now. Technology has always played a central role in the world of finance, albeit in different forms. The credit card has been around since the 1950s, and the first ATMs were introduced back in 1969. However, since the rise of the Internet and smartphones, financial applications have skyrocketed, making use of modern technologies such as machine learning algorithms, data science, and blockchain.

Banking

Mobile banking forms a core part of the FinTech industry. If you own a smartphone, you probably have a mobile banking app installed on it to easily check your balances, send payment requests, transfer money, and get insights into your spending behavior with visualized analytics, with just a few taps on your screen. An upcoming trend in the mobile banking industry is the so-called “neobank”, which are essentially banks but without any physical locations. All banking processes are done online in a fully digitalized infrastructure.

Insurance

InsurTech is defined by the combination of the terms “insurance” and “technology”, and forms its branch of the FinTech industry. Any kind of technology used by insurance companies to automate/optimize efficiency and other internal processes like customer services are considered InsurTech. From physical product insurance (such as homeowner, car, boat, etc. insurance) to health insurance, the industry is following the digitalization trend of the immense popularity of FinTech. The use of technologies in insurance services can greatly optimize internal insurance procedures, formulas, and much more, saving expenses on both the customer and company sides of the insurance market.

Examples of how InsurTech streamlines its processes are the use of chatbots, which can optimize the customer experience, or the automation of the entire insurance provider lifecycle (application, acceptance, payment, and claim processes). With a digital InsurTech platform, you can fix things like your health insurance without talking to a single person or physically signing a single piece of paper.

Cryptocurrency

Although cryptocurrencies like Bitcoin are usually seen as an industry on their own, it most certainly has deep connections with the FinTech industry. As cryptocurrencies are becoming increasingly popular, it can be expected that they will become a part of our future financial system. Governments and major financial institutions are keeping a close eye on the cryptocurrency trend and even working towards creating their digital currencies, as it provides a heightened sense of security and speeds up business/payment processes.

Investments & Loans

A popular trend in FinTech software is using big data and technology to do risk modeling and analyses related to loans and investments, speeding up contracting and approval processes as well as decreasing the risk of financial setbacks. FinTech is becoming a major player in reshaping Small-Medium Enterprises’ (SME) lending procedures by simplifying the process of connecting financial providers (FP) to SME’s looking for the funds they need to expand.

Project: ebol.

Our clients from ebol. provide financial services and facilitate the loan process between financial providers and small and medium-sized companies. Specialized in FinTech (financial technologies), ebol.is always looking for innovative solutions for the financial sector. To optimize their services, ebol. wanted to develop a digital platform on which small and medium-sized businesses can find and match potential financial providers such as banks. The main goal of this digital environment is to facilitate the process of searching and matching between financial providers and businesses to secure small loans.

Together with ebol., Lizard Global designed and developed a digital environment that simplifies the process of searching for potential financial providers (FPs) for small and medium-sized enterprises (SMEs). The two-sided marketplace of ebol. allows businesses to get in touch with financial institutions, like banks, to establish loans.

Project: Contract Chain

The Contract Chain application allows organizations to create, manage, review, and sign contracts in a digital environment. By using blockchain technology, these contracts once reviewed and signed are traceable, transparent, and irreversible, making it one of the most secure contract signing tools in the world. In order to make sure all data of internal processes are handled securely, companies need to have all information stored in a so-called processor agreement. This can be done on paper, but companies with a lot of processing agreements tend to struggle with keeping track of all agreements while ensuring that every document is up-to-date. This struggle asked for a sustainable solution which both simplifies the process of managing digital contracts, as well as optimizing the protection of all user data.

The Contract Chain application and its handling of data run on blockchain technology, which facilitates the safe verification and handling of data transactions. Because blockchain technology is a decentralized system, it exists between all involved parties and takes over the role of a human intermediary or middleman. The technology behind Contract Chain is a perfect example of a FinTech solution. Financial service processes like signing contracts for loans, investments, and payments are becoming much easier and more efficient with the use of automation, and much safer with the use of blockchain technology.

Project: WorldKoins

WorldKoins is a startup platform where small amounts of foreign currency can be exchanged with a virtual currency. With this virtual money, users can buy gift cards and vouchers from renowned companies like Amazon. WorldKoins recognized the problem of the small, residual amounts of foreign currency travelers had left at the end of their trip and couldn’t get rid of. Instead of keeping the money or going to an exchange bank, usually with high commission fees, they should be able to find people who are looking for the same currency in order to exchange their leftover money. Together with WorldKoins, Lizard Global created a platform that connects people who are in possession of “WorldKoins” and are looking for a place to exchange foreign currencies with people who want to get rid of that particular currency. WorldKoins can be exchanged for vouchers with which other products can be bought.

Project: Brickler

Brickler

is a startup innovated by Nationale Nederlanden's mortgages department that takes on the function of the housing market by making it easier to search properties by region, compare mortgages, and apply for loans online. Nationale Nederlanden (NN) aimed to build a single platform where customers could search for a home and apply for a mortgage, all in one digital environment.

Nationale Nederlanden required a professional digital partner who could think through the process in order to optimize the user experience. Lizard Global partnered up with Nationale Nederlanden in order to create a platform that allows consumers to seek a mortgage through a mobile app. Brickler evolved into a cost-effective digital option for home seekers.

Lizard Global and FinTech

With an already impressive portfolio of FinTech projects, Lizard Global is experienced in creating digital solutions to support the digital transformation of various types of financial institutions and services. Not only does our skilled team know exactly what types of technology can optimize the internal processes of your financial business, but we also know that your digital solution needs a solid security system. Applications handling financial business possess a sensitivity regarding the safety of user data, as well as money transfers and more. That’s why we develop apps with security by default and privacy by design. This guarantees the safety of user data that is embedded in the design of our digital solutions. Our app developers create their code in such a way that it requires the least amount of user data in order to function properly.

Want to know more about our secure solutions? Check out our Security Document.

Need a hand?

Curious about our other verticals? Check out our portfolio for an insight into all the industries we’re supporting with digital solutions. Want to know more about our verticals and the clients we’re guiding towards the digital transformation of their business? Or do you want to know what we can do for your business? Drop us a line, and we gladly meet up with you to dive into the possibilities!

FAQs

What is FinTech?

What is InsurTech?

What does digital transformation mean?

How does a digital transformation work?

What does digital transformation in financial services look like?

Where can I find Lizard Global’s Projects?

similar reads

Software Development/Salesforce CRM

Integrating CRM Systems With Lizard Global

22 February 2023

Digital Transformation & Automation

Agile Methodology

Lean Analytics

Implementing CI/CD With Lizard Global

22 February 2023

Company Culture & Milestoness

Understanding Your Users With Our Design Thinking Workshop

22 February 2023